Can we skip the budget section of the financial statement? It’s such a hassle and we’re using child and spousal support calculators nowadays anyway.

In Defense of the (Family Law) Budget

Completing the family law financial statement budget is one of the first formalities in which a family law mediator will face push-back. It’s too complicated, too confusing, too time consuming, will cause too much delay, it’s pointless if we primarily rely on gross income for child support and spousal support calculations, it’s not relevant where the only issue is property.

Did I miss any? Oh, yes. Those were the negative complaints. Here are the positive complaints:

We have simple finances. We agreed to keep costs down. We agreed to skip the income and expenses sections entirely and just rely on our notices of assessment. We’re amicable. We’re trying to stay big picture and don’t want to unnecessarily ruffle any feathers (which you, dear mediator, are doing). We already agree on the children’s expenses and to just divide them equally. We’re not intending to go to lawyers for independent legal advice (ILA).

I’m sympathetic to some of these comments, although an internal flag should be raised on identifying power imbalances if the positive complaints are provided. But take a moment to employ some empathy and look at it from the client’s perspective:

• The last thing a person dealing with the uncertainty of separation cares about is completing an onerous financial form.

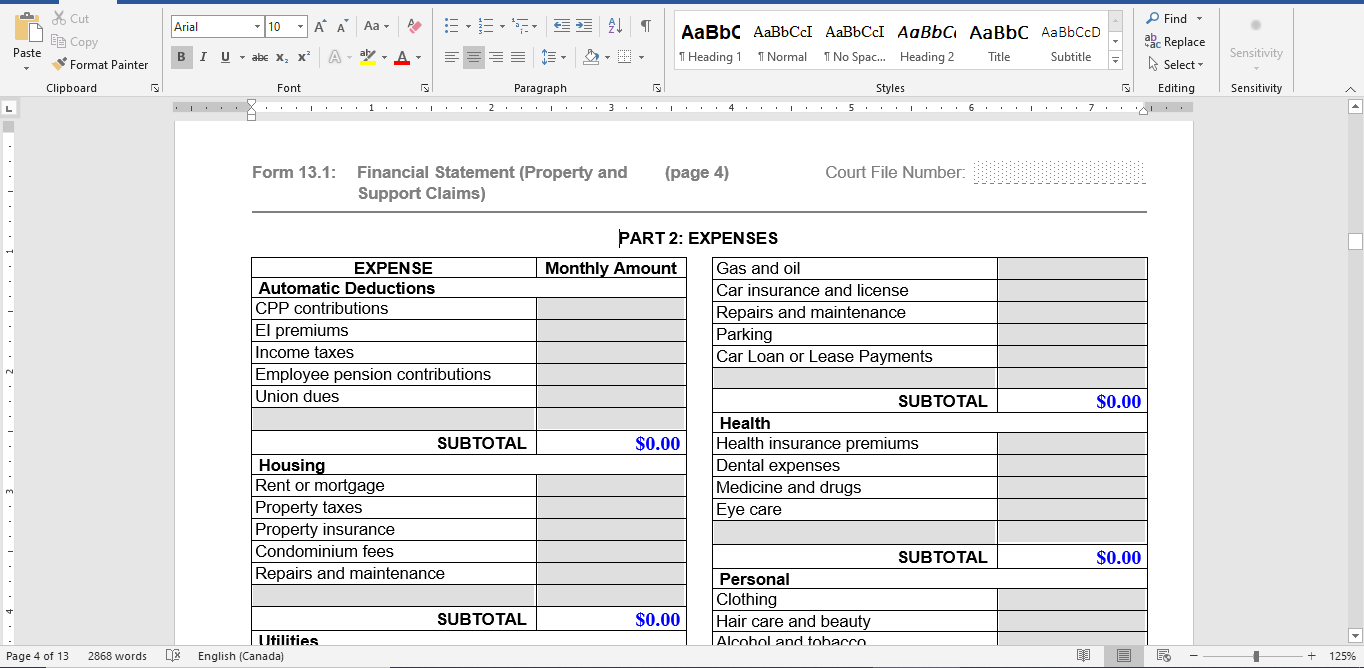

• There is an innate dissonance between a fixed form and the reality it is meant to reflect: How do you perceive monthly “groceries” and “household supplies”? For me, it’s a not a monthly amount at all. It’s a weekly shop at No Frills and a visit to Costco every two weeks, with the odd trip to Canadian Tire. Trips to Shoppers Drug Mart or Rexall can include medicine, groceries and household items.

• What is even being asked of me? Is this budget meant to reflect what was, what is, or what I want it to be? Where do one-time expenses, like a new roof, go? I didn’t go on a vacation because of the current circumstances, but I’d like to and ‘we’ used to.

• “Alcohol and Tobacco” – judgey much?

• Am I going to be interrogated for having my hair done?

Let’s go one step further: how many “easy” employed people can figure out their payroll deductions? For the self-employed, how do you know how one carves out the deducted portion of meals, car/gas and ‘business use of home’ from your personal budget?

Some of these problems may partially be resolved by technology that adapts the form to the user, but we are certainly not there yet. Some mediators create their own forms (not without their own problems). So, for the moment, let’s deal with what is in front of us, now.

(i) The Budget, in Law

If any of the following scenarios or legal issues are likely to be discussed, the law provides within its own framework to consider “the needs, means and conditions of each party and (where relevant) the children”, or to determine an amount that is “appropriate”, all of which is code for a more nuanced look at the specific facts and budgets for the family. Additionally, lawyers very technically need this information for independent legal advice (ILA):

• Spousal support, especially where an income is over $350,000

• ‘Adult’ child support

• Child support where an income is over $150,000

• Step-parent support

• “Shared custody”

• Undue hardship

Moreover, if there are any extraordinary (“section 7”) child expense claims, the Child Support Guidelines provide an analysis for the ‘necessity’ and ‘reasonableness’ of the claimed expenses. The framework for determining ‘reasonableness’ includes “the amount of the expense in relation to the income of the spouse/parent requesting the amount” and “the overall cost of the programs and activities”, i.e. budget.

(ii) Explaining The Budget to Clients

In mediation theory and practice, there is much said about “reality checking”. Aside from the legal aspects above, the budget’s primary role is to fact-check the ‘income’ representations in the party’s financial statement against their ‘net worth’ representations, and vice versa. The budget connects a person’s income to their net worth the way a bicycle chain connects the pedals to its wheels: you can see whether the chain ‘fits’ to the claimed direction of movement of either.

If a party is self-employed claiming $200,000 income gross of expenses and $25,000 income net of expenses, and their budget shows monthly rent payments of $2,000, that information alone provides everyone in the room some indication that there is a problem with ‘fit’, unless there is some additional information provided either about money coming in (including reality checking the claimed gross income, the deducted expenses or even support from extended family) on the one hand or reduction in net worth (depleting assets or assuming debt) on the other. Change ‘rent’ to ‘mortgage’ and the issue of fit becomes even more disparate, as the payment increases net worth.

Additionally, the budget can unearth – even inadvertently – a wealth of information overlooked by clients in both the income and net worth portions of the financial statement:

• Payroll deductions to employee savings accounts

• Payroll deductions for life insurance and health insurance

• Car expenses to vehicles

• Debt payments to store credit cards

• The lack of certain expenses, e.g. a cell phone expense, to employee benefits

• The existence of RESPs

So, explain to the resistant client(s) the idea that the financial statement as a whole is not just a form to plug in data. It is telling a story, and even if the issue is just income (support) or the reasonableness of s. 7 expenses or the completeness of net worth on a given date (property division), the entire document needs to be completed, to reality check the story being told. In each mediation, you can explain why each party has an interest to want the confidence in the other person’s story, and an interest to provide confidence of their own story to the other party.

Originally published in the FDRIO Newletter, July 2019

Disclaimer:

Just as you ought to speak to a doctor before relying or applying medical information you find on the internet, you should speak to a legal professional before relying or applying legal information you read on the internet. If you are looking for quick, competent and affordable advice for family law financial disclosure, learn more and book your appointment.

Help is Here

Disclosure Clinic does one thing: Family Law Financial Disclosure, done right.

personalized disclosure

Quickly get your needed documents together so your disclosure doesn’t become the story.

Motions to change

Nowhere is telling your story more important than a motion to change.

ENDLESS DISCLOSURE REQUESTS

Determining what disclosure is relevant and cogently presenting it.